Welcome to the Lead5 Executive Empowerment Center

Hello, Josh Wimberley here, CEO and founder of Lead5 – The Executive Career Platform. I wrote this blog to help you elevate your executive career by highlighting the 5 dimensions that successful executives must master. It’s also intended to be a reference guide for Lead5 members to help them get the most value from the platform. I have broken this information into 6 modules. Please email me anytime with your feedback or if I can assist you in any way! josh@lead5.com

Your partner in success,

Josh Wimberley

Module 1: Unveiling the Hidden C-Level Career World

Before forming Lead5, I led the largest executive search firm’s CFO practice. In over two decades, I have helped 100’s of C-level executives just like you advance their careers and achieve their goals. As such, allow me to share some important C-level recruiting insights that you were probably unaware of:

– Most of what you think about managing your executive career is wrong because most of the key information is hidden. This hidden information includes: job opportunities, insider intel, and meaningful ways to network. I formed Lead5 to unlock those doors and I will be covering these elements in more detail in this blog.

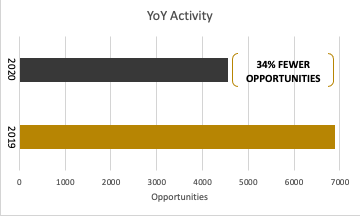

– The proactive executive always has the edge on new opportunities. As an executive, you have been trained to wait on a recruiter’s call that may never come. You’re also probably relying too heavily on your personal network. These approaches provide you with only a fraction of the total opportunities available to you. Through a combination of AI, dedicated research teams, and crowd-sourcing, Lead5 provides you with instant access to hidden executive jobs, expanding your universe of opportunities.

– Your openness to relocation is a critically important variable for your success. Most c-levels will move multiple times over the course of their careers, and an unwillingness to relocate will ultimately hold you back in your career. Lead5 helps you find opportunities worth the move, wherever you are.

– A ‘full-cycle career plan’ is your means to continue your success in today’s challenging economic climate, and Lead5 is built around the 5 dimensions that comprise this career strategy. Executives are often so maximized in their current role that they think about their career through only 2 dimensions: managing their current role and then scrambling to find their next one, and often, when it’s too late. You must understand that it typically takes 4-6 months for executives to find their next opportunity, and this is during strong economies. The Lead5 Executive Community keeps you connected throughout your career life cycle with thoughtful insights and discussion, expanded opportunities and key contacts.

Lead5 Is Built Around the Following 5 Dimensions That Successful Executives Must Master:

1. Proactive Opportunity Outreach

2. Continuous Networking

3. Honing Your Skill Set

4. Connecting with Peers

5. Establishing Yourself as a Thought Leader

Because this 5-dimension full-cycle career plan is so important, we offer a complimentary phone consultation to help you develop this approach. To set up this up, please contact me: josh@lead5.com

Module 2: Personalize Lead5 and Maximize Your Results

My5 is the name of Lead5’s search filters that you will set to deliver to you personalized open opportunities and career intel on the Lead5 Platform. My5 consists of the 5 company attributes that most C-level executives consider as they pursue their next opportunity.

The My5 components are:

1. Function

2. Industry

3. Region

4. Market Cap

5. Ownership Structure

Once you’ve set your My5 filters, you will see focused opportunities and intel in your dashboard, and you can quickly apply these filters in the section called “Jobs & Intel.”

As your search criteria changes, remember to keep your My5 filters up to date so that Lead5 can work for you optimally.

My5 Search Filters are located at top of all Lead5 web pages:

My5 Search Filters: Simple check boxes give you complete control:

Tip: Expand the plus symbol (+) for more granular filters.

My5 Search Filters personalize your dashboard view:

Apply your My5 Search Filters with 1 click:

By selecting “Apply My5”, you quickly surface relevant intel when browsing.

Module 3: ‘Potential’ and ‘Verified’ Opportunities on Lead5: What’s the Difference?

To maximize your total universe of opportunities for your outreach, Lead5 offers two types of opportunities – ‘potential opportunities’ and ‘verified opportunities.’ Here’s what you should know about these.

Potential Opportunity – This means that Lead5 has discovered that a company will likely be looking to fill an opening soon. Not every potential opportunity evolves into an actual opening, but potential opportunities have significant value because candidates can enter a potential job search at the earliest possible moment, increasing their likelihood of being discovered.

– How to Pursue Potential Opportunities: We advise members to reach-out to a ‘recommended contact’ that we provide and make an introduction.

Remember: making a connection is always the first step to landing an executive role. Even if a potential opportunity doesn’t pan out, making a positive impression expands your network and could open up new doors in the future.

Verified Opportunity – This means that Lead5 has uncovered intel that a company is actively seeking to fill this role.

– How to Pursue Verified Opportunities: We advise members to reach out to the recommended contact and/or recruiter. In some cases, an application link is provided. At a minimum, you should strive to make a connection and broaden your executive network.

Action: Once you’ve identified an opportunity to pursue – whether potential or verified – click the “Pursue Opportunity” button on the opportunity details view. This will trigger the ‘Lead5 Advisor’ which will make a recommendation on the best approach.

Here’s an example opportunity:

Most of our opportunities are unlisted, meaning there’s no online application. Once you click the “Pursue This Opportunity” button, it launches the Lead5 Advisor to organize your steps.

The Lead5 Advisor:

The “Lead5 Advisor” Provides Action Steps

When launched, the Lead5 Advisor gives you specific guidance, recommended contacts, email templates, and more — everything you need to pursue opportunities of any type.

Additionally, we provide suggested email outreach templates to help guide your messaging to the suggested contact(s).

Module 4: Use Your Lead5 Playbook to Maximize Your Productivity

A full cycle career approach includes proactive outreach and continuous networking. To perform these tasks effectively, we built the Lead5 Playbook to help you organize your activities and store important data.

Your Lead5 Playbook helps you track, plan, and organize:

– Opportunities you wish to pursue in the future

– Opportunities you’ve already pursued

– Contacts you wish to reach out to

– Phone call notes

– Future scheduled activities

Here is a My Playbook example:

Your time is valuable. By using your Lead5 Playbook, you can maximize your productivity on Lead5.com.

Module 5: Harness Lead5’s Intel to Elevate Your Career

Utilizing insider intel is key to your executive success. Lead5 offers actionable intel that will help you in every stage of your career life cycle. This intel can be found in the ‘jobs & intel’ and in the ‘community’ sections on Lead5.com.

Verified Opportunity – This means that Lead5 has uncovered intel that a company is actively seeking to fill this role.

Action: You can pursue this role or make important connections with key company contacts.

Potential Opportunity – This means that Lead5 has discovered that a company will likely be looking to fill an opening soon. Not every potential opportunity evolves into an actual opening, but potential opportunities have significant value because candidates can enter a potential job search at the earliest possible moment, increasing their odds of being discovered.

Action: You can pursue this role or make important connections with key company contacts.

Executive Moves: typically covers executive appointments which indicates a near term executive hiring (example: CEO will soon be appointed and will seek to build his/her team). These executive appointments all signal potential changes in vendors and suppliers.

Action: This is a perfect moment for you to make a connection.

The Lead5 Executive Community: here you can exchange intel with an exclusive membership base comprised of your executive peers. These intel focal points are: opportunities, career insights, and career best practices.

Action: This is a forum where you can establish yourself as a thought leader, hone your skills, and connect with peers in a meaningful way.

Private Equity Deals: represent acquisitions or assumption of a controlling interest in a portfolio company. These deals indicate near-term C-level executive hiring flows, new growth capital, and potential changes in vendors and suppliers. Most PE-backed companies replace the executive team in the first 6 months of the deal closing.

Action: This is a perfect moment to make a connection to the PE deal partner while new leadership teams are being formed.

Module 6: Connect With The Lead5 Executive Community

Connecting with peers and establishing yourself as a thought leader are important fundamentals to achieving full cycle executive career success. In an economic environment that is increasingly isolated, we have received feedback from members who have expressed a desire to connect and contribute. In response, we recently launched The Lead5 Executive Community to help you exchange information with our exclusive network of top executives and executive career experts.

This information includes:

– Member-Contributed Opportunities

– Career-empowering insights

– C-level best practices

It only takes one opportunity, insight, or connection to elevate your career or the career of one of your peers. As the Lead5 Executive Community continues to grow, our members will reap the benefits.

Here are some specific ways that you can benefit and contribute:

– Ask a confidential career question on our message board and receive insights from peers and the Lead5 leadership team who has decades of experience in executive recruiting and executive career management

– Submit an opportunity that may not be the right fit for you

– Provide impactful insights that helps your peers and establishes yourself as a thought leader

Participation is completely voluntary and you have the option to provide information under your name or anonymously.

I hope this blog has been useful to you. Please email me anytime with your feedback or questions. josh@lead5.com

Your partner in success,

Josh Wimberley

Lead5 CEO